MHM Automation’s interim report for the 6 months ending 31 December 2022 stated the company’s revenue had increased by 45% to $42.8 million, its operating EBITDA grew by 109% to $4.44 million and net profit after tax was $3.08 million for the period.

MHM Automation CEO Richard Rookes attributes the company's continued growth to strong customer demand across its product and service range, as a result of the mega-trend of increasing automation for manufacturing businesses.

“Our diversification strategy has served us well through global uncertainties over the last few years. But I’m pleased to report that in the last six months all our business units have been performing well, thanks to customer demand for our solutions,” he said.

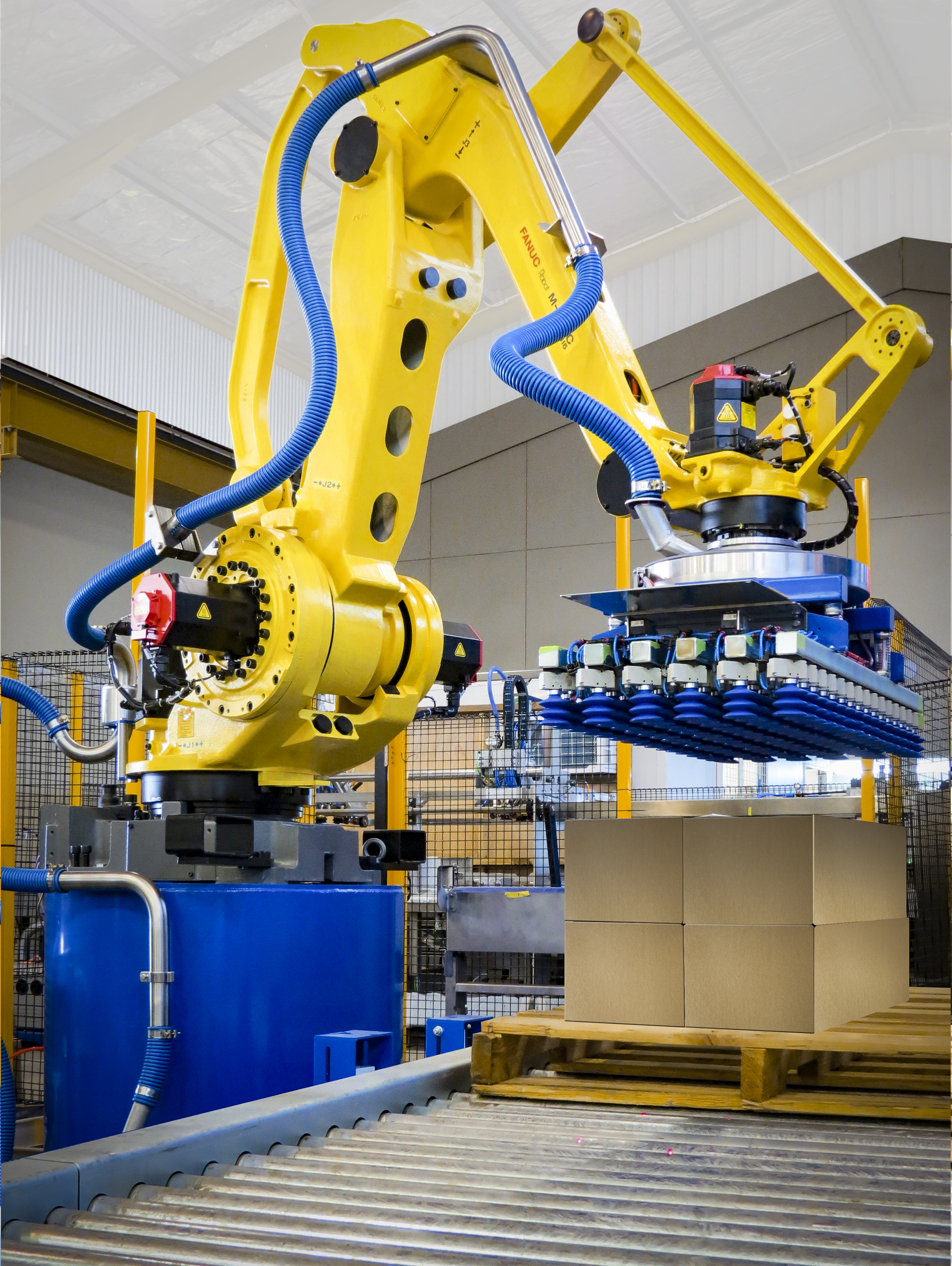

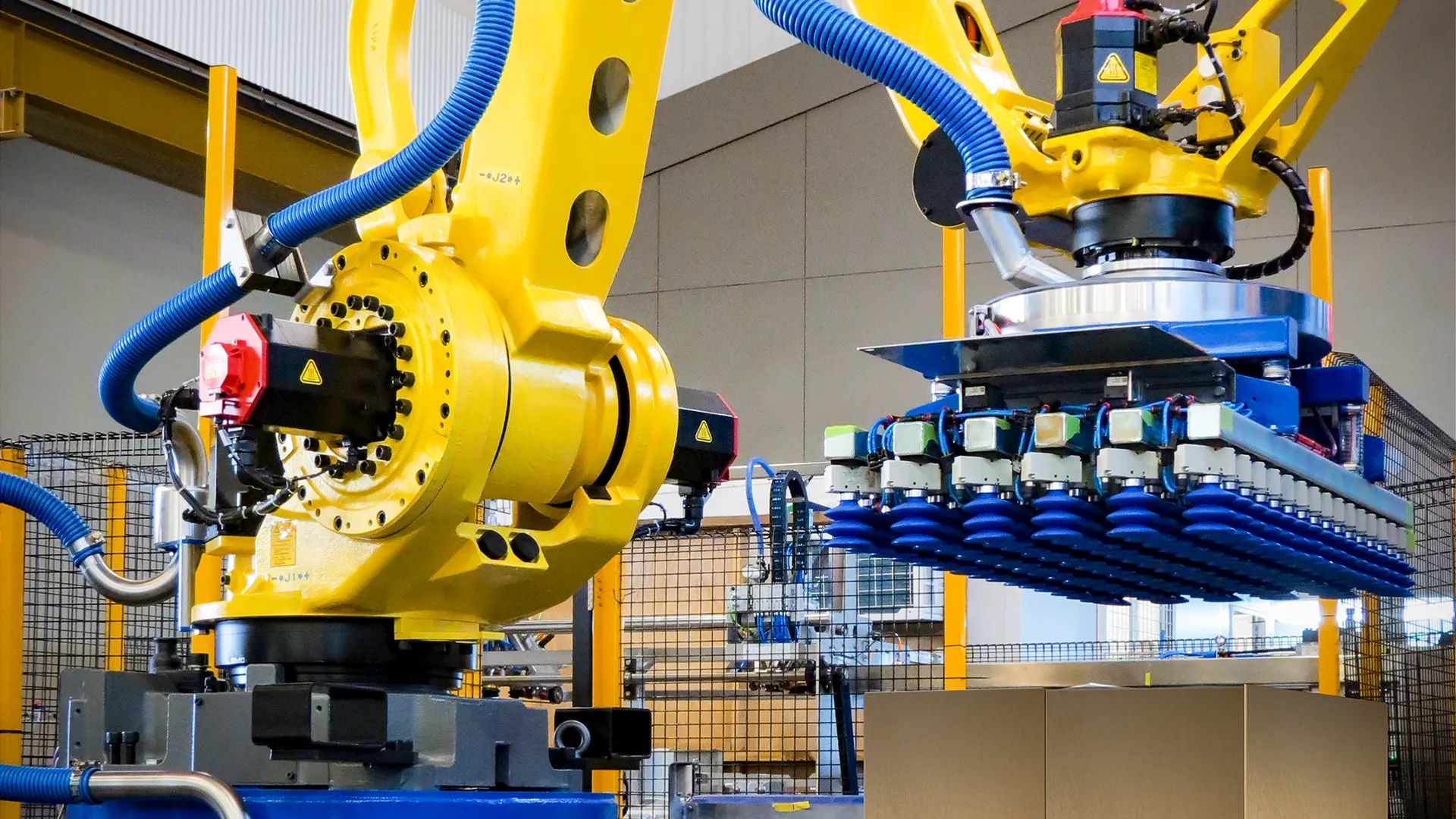

Project highlights for the period included an $8 million palletising project delivered to a Queensland-based manufacturer in a short timeframe, following flood damage in 2022.

Mr Rookes said the project had been successfully delivered in a record timeframe thanks to the team working above full capacity.

“This is a real credit to the capability and culture of our H&C team,” he said.

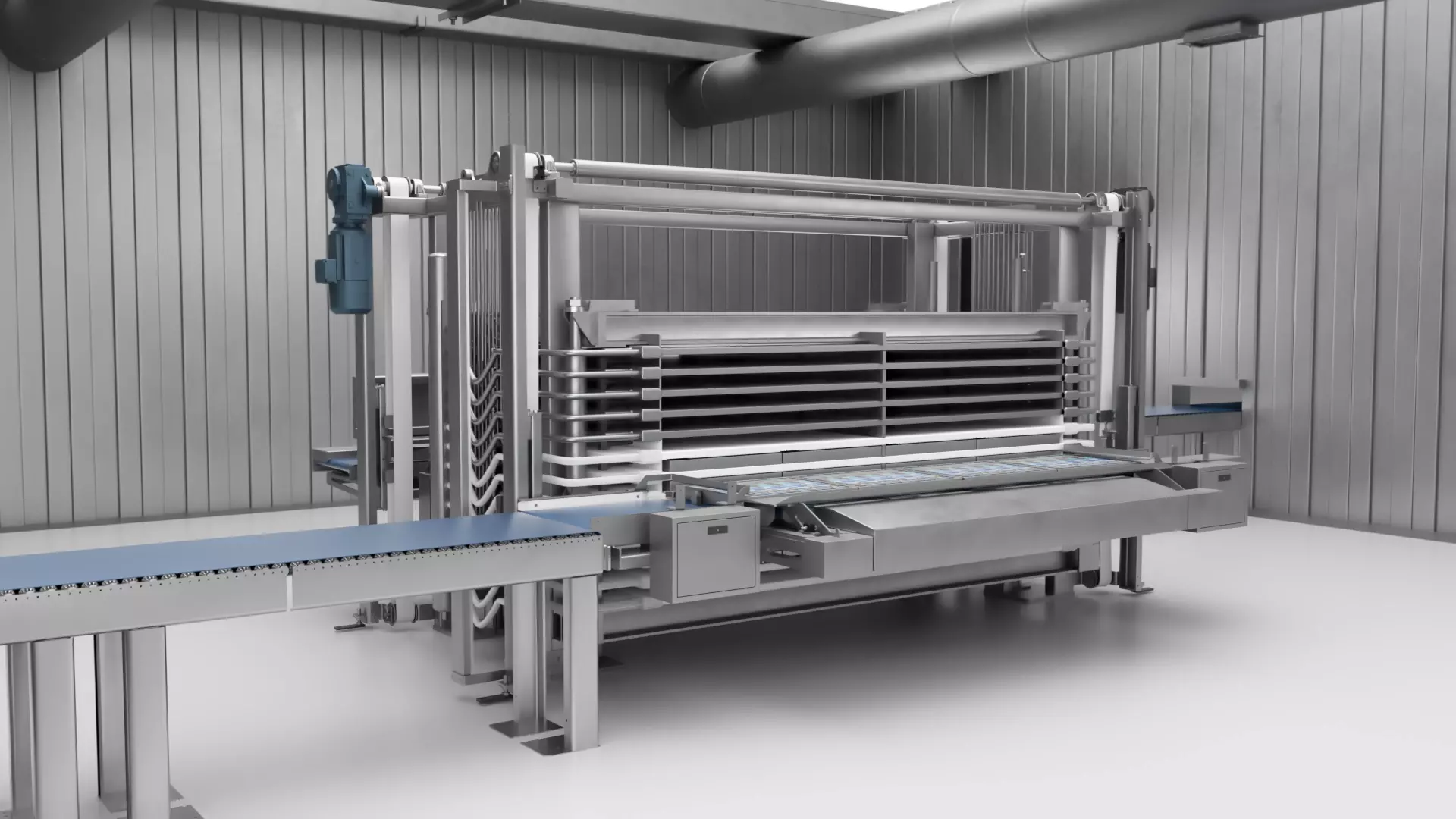

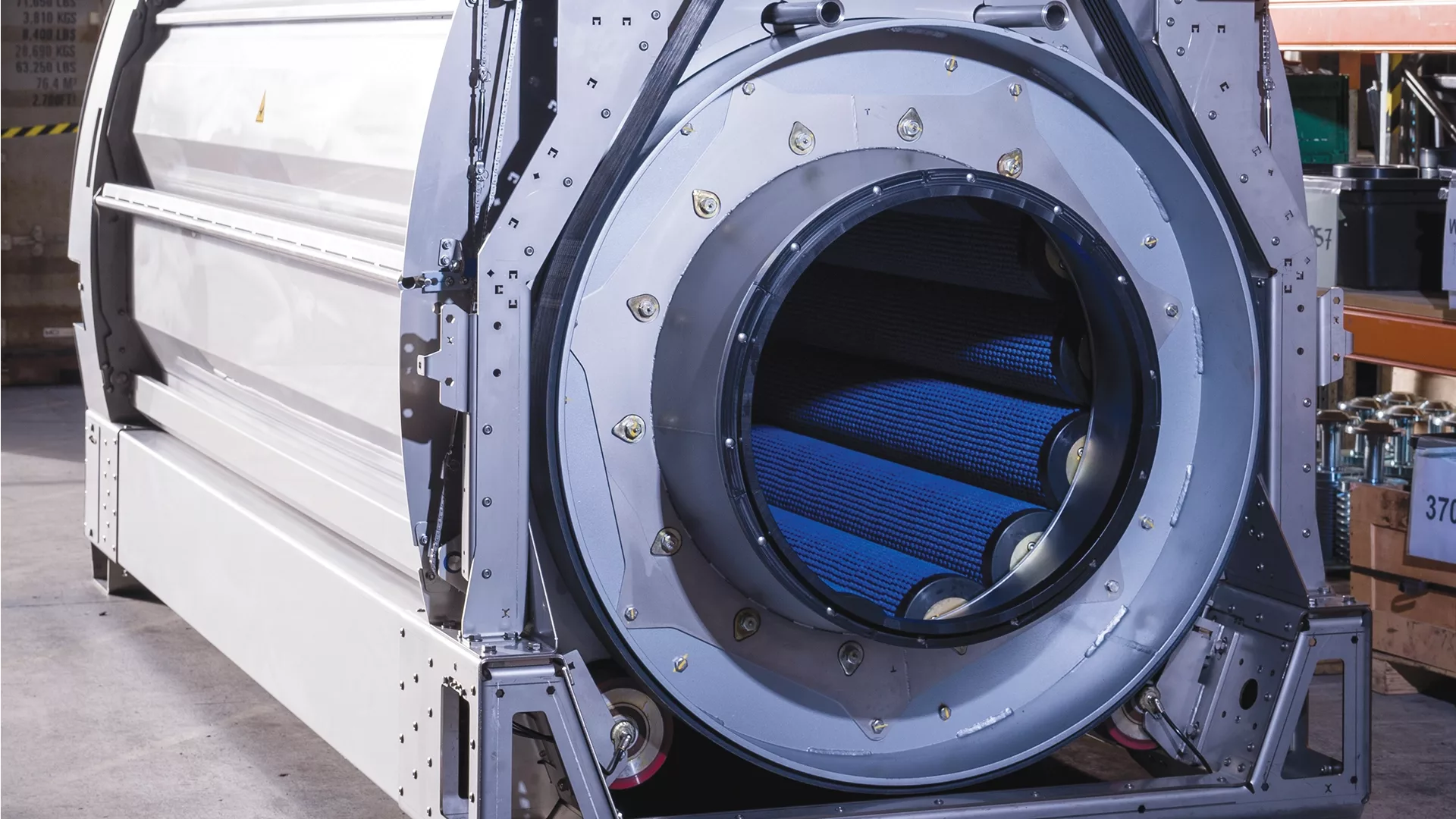

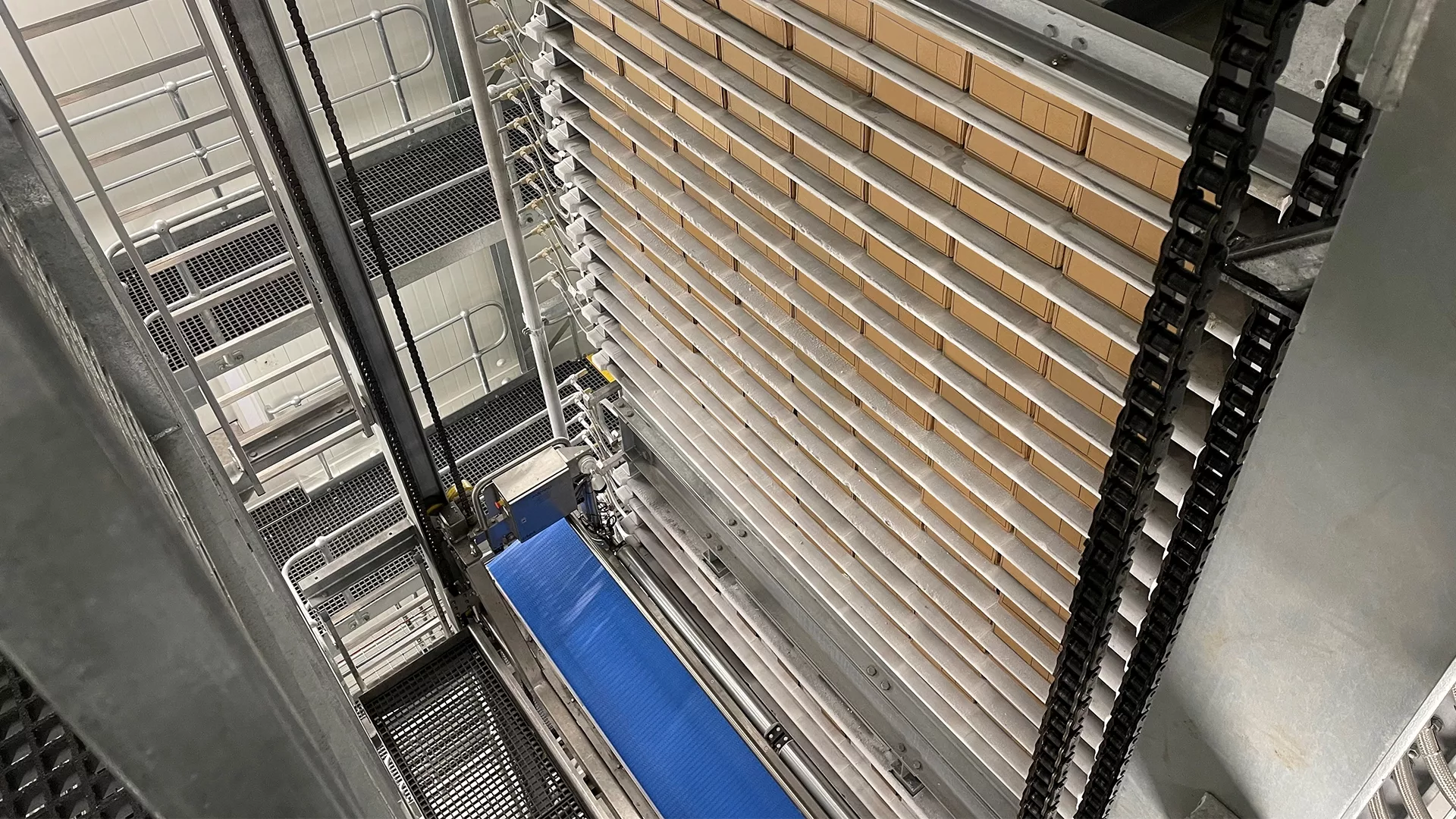

Several chilling and freezing installations were also strong contributors, including the first Milmeq SRT freezing tunnel to be delivered into the North American meat sector.

Mr Rookes said he expected the positive momentum to continue for the remainder of the 2023 financial year and beyond, with almost $55 million of contracted forward work and the acquisition of Wyma expected to take place in April.

In December, MHM Automation entered into a conditional agreement to acquire Wyma Engineering Limited, a leading manufacturer of post-harvest vegetable and fruit handling equipment based in Christchurch, New Zealand.

The proposed acquisition values Wyma's business at $60 million and Mr Rookes said the company is optimistic about the acquisition.

“This is a pivotal transaction that potentially doubles our size and achieves the Step 100 strategy, which we put in place 15 months ago. We are working through the conditions and remain on track to settle the transaction on 3 April 2023,” he said.

There will be a special meeting of shareholders to approve the transaction held in March, with details to be released.