Delivering an after-tax profit of $4.1 million, this is a 339% increase on the previous year’s result. The company reported revenue for the year of $50.9m, a 6.1% increase on 2020, and the full year EBITDA increased by 50% to $3.73m. The growth was primarily driven by a strong performance from its Milmeq chilling and freezing business.

“I am pleased to see the momentum we’ve been building over the past few years continue and we remained focused on strengthening our automation business while also improving profitability,” CEO Richard Rookes said.

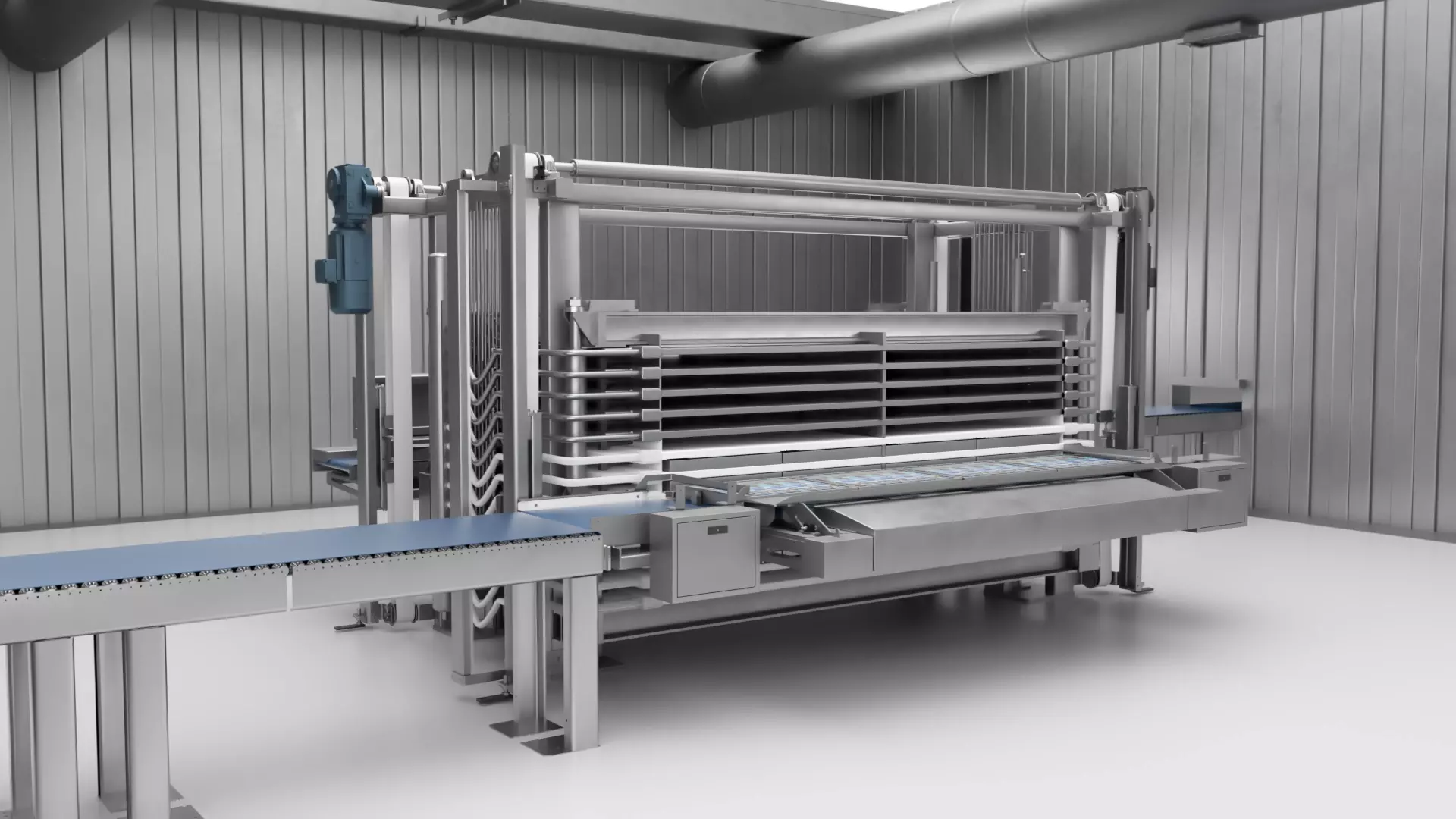

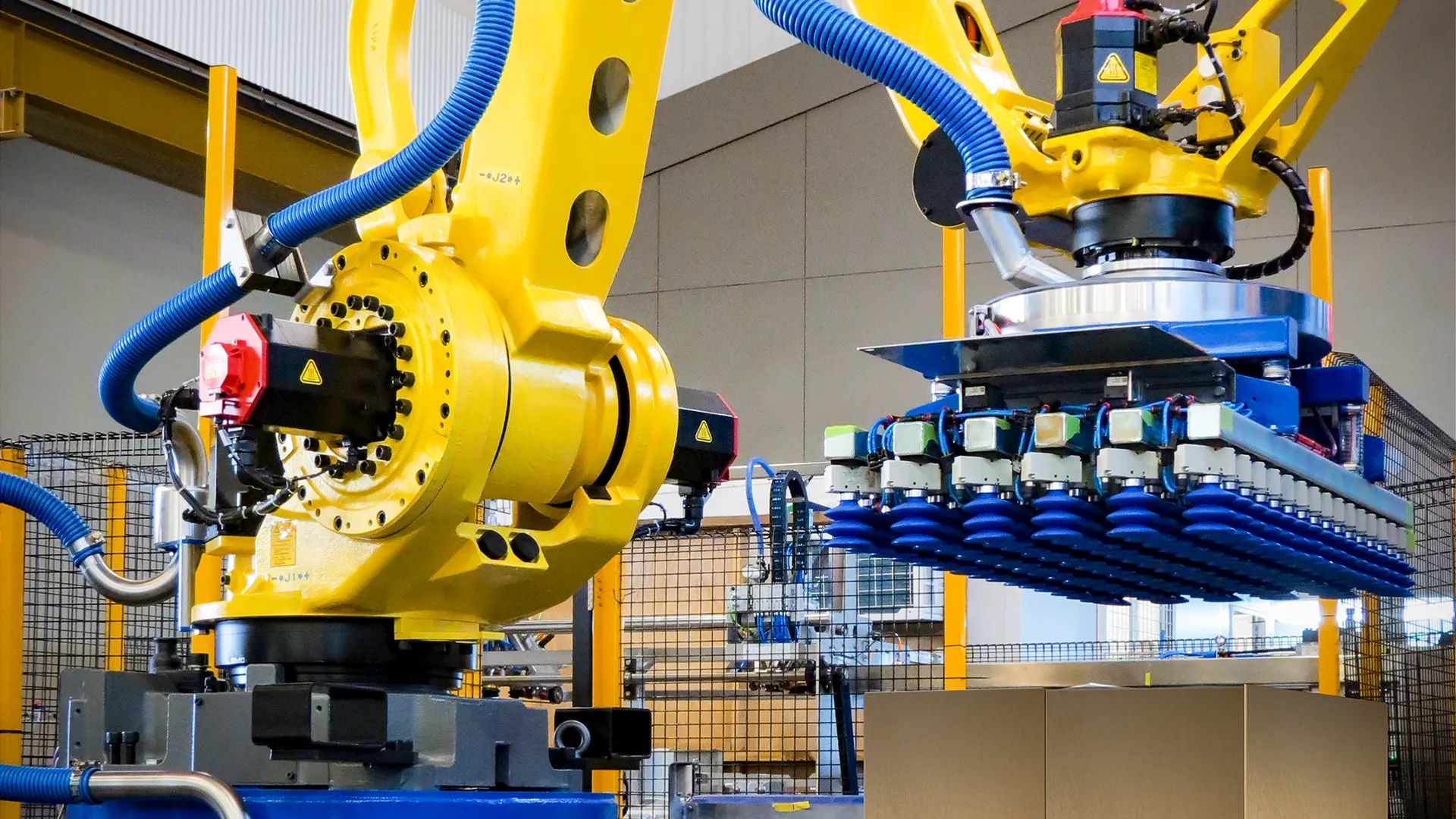

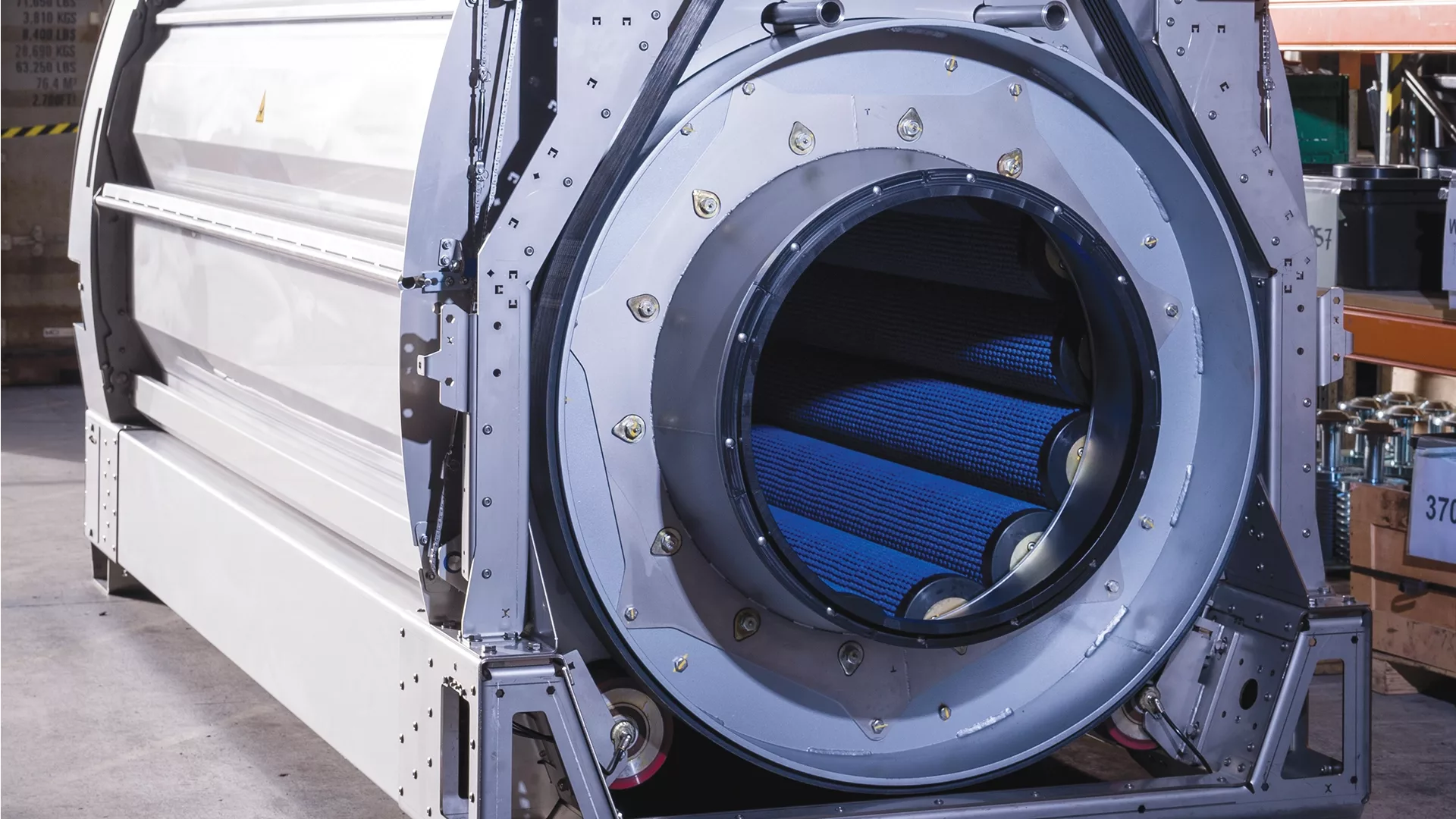

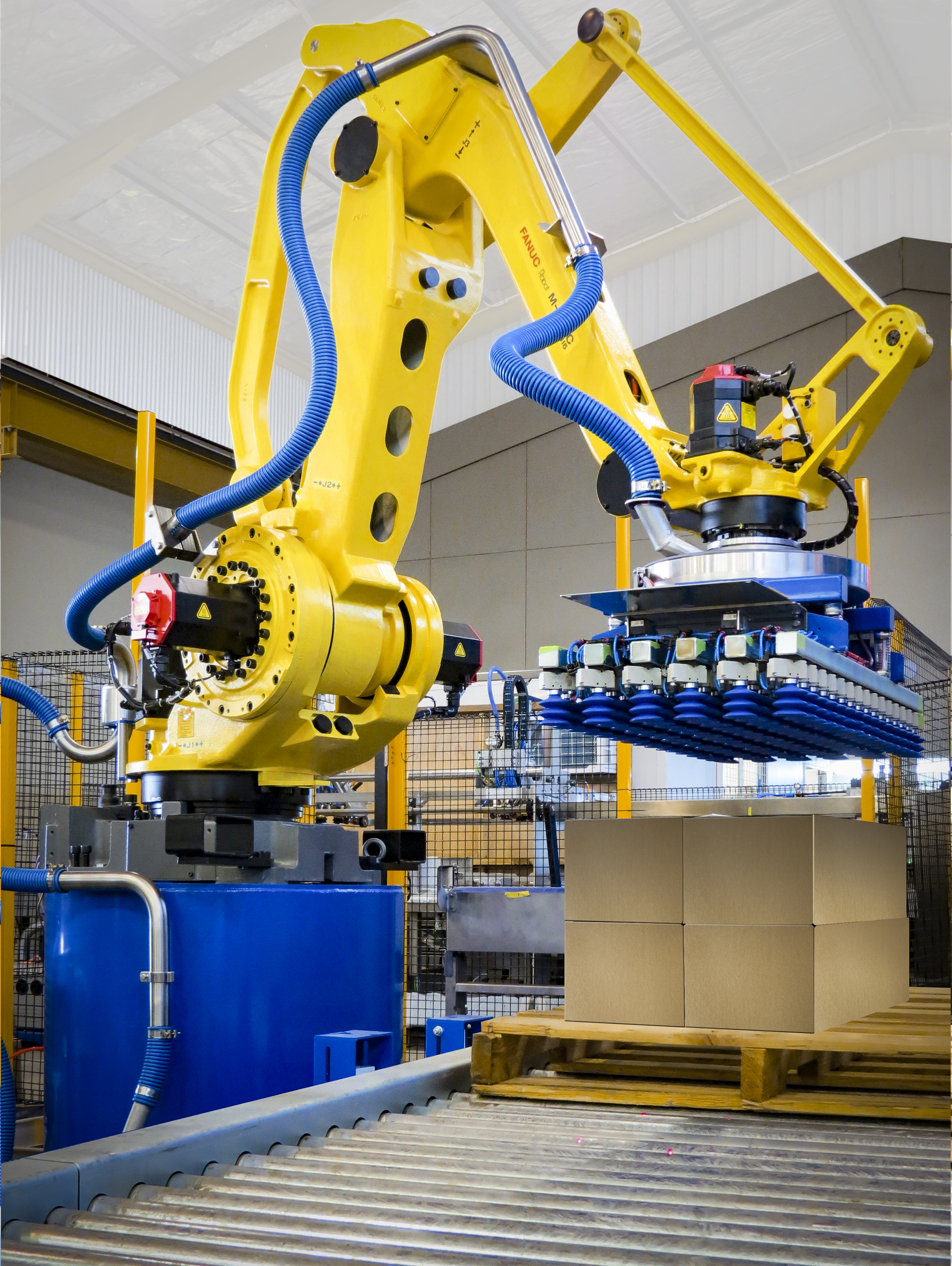

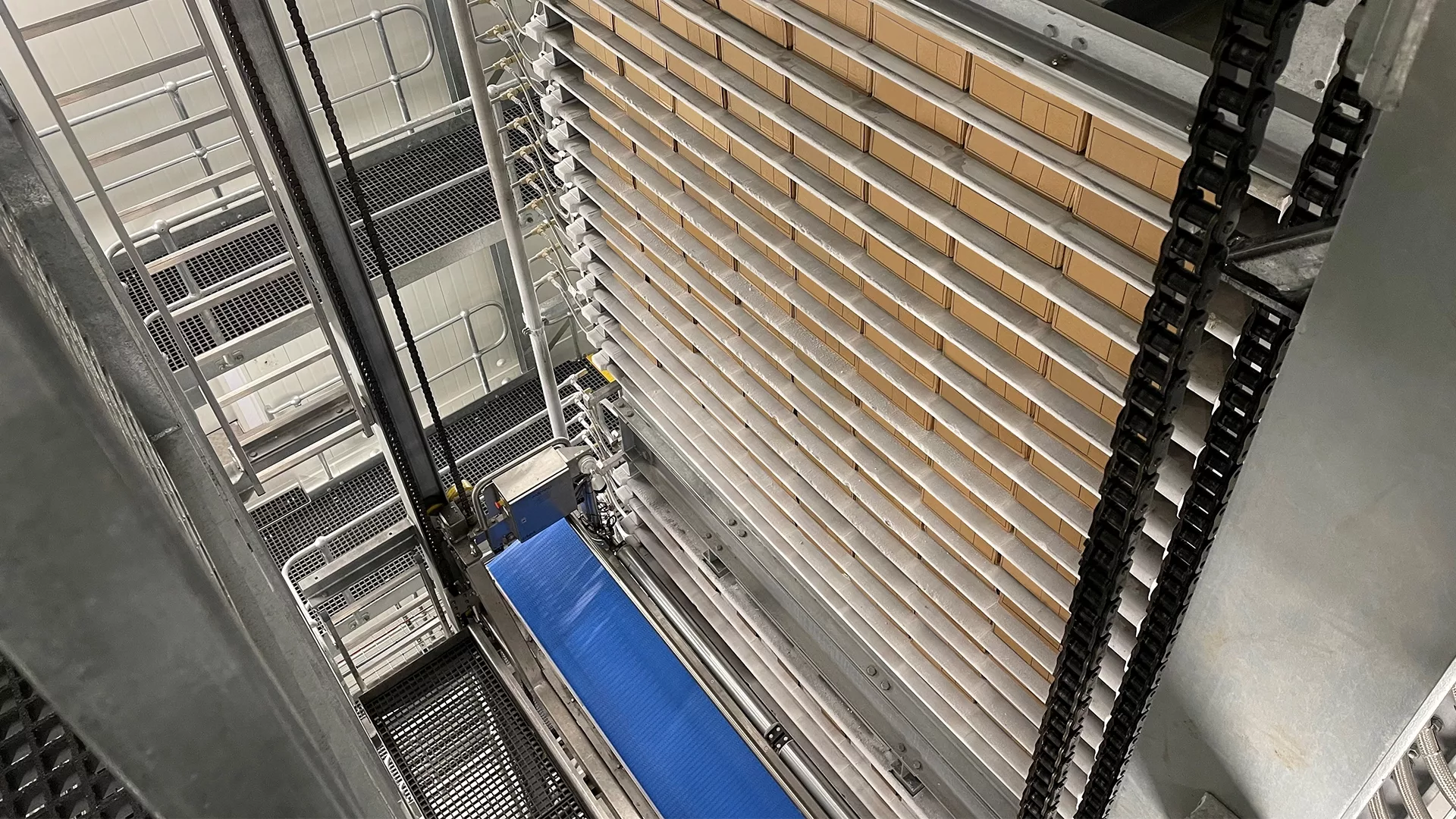

MHM Automation services the global dairy, meat, horticulture and food processing sectors.

Rookes said the COVID-19 pandemic had meant its customers were increasingly looking to automation to ease the challenges of social distancing and ensure compliance with food safety standards, as well as addressing labour shortages and health and safety concerns. But delivering projects during the pandemic had been challenging, due to resource constraints and restrictions on international travel, particularly the MIQ system.

“Achieving this high level of performance in a COVID-19 world is testament to our team, and the strength and relevance of the products and solutions we design and deliver,” he said.

MHM Automation is largely made up two business streams – automation and fabrication. In recent years the company has turned to automation as its primary focus for growth, with the acquisition of H&C in 2016 and Milmeq in 2018 being core to this strategy.

For the 2021 financial year the automation division made up 78% of group sales revenue, versus 61% for the prior year. The fabrication business generated revenue of $12.8m and EBITDA of $597,000 for the financial year, also an improvement on the previous year.

The company has also placed emphasis on ensuring the ongoing viability of its fabrication business through diversification. The acquisition of Christchurch-based engineering company Southern Cross Engineering was a significant step forward in this endeavour.

Rookes said the acquisition provided MHM Automation’s fabrication side of the business with additional scale and the ability to pivot from supplying to the dairy industry, which it had traditionally been reliant upon.

“Bringing SCE into the MHM Automation group allows us to continue to deliver on SCE’s leading market position in the Australasian timber industry, as well as opening up doors into other key primary sectors such as the grain industry,” he said.

2021 also saw MHM Automation transition its brand and business units from the former Mercer Group identity. The rebrand has unfolded alongside the company’s restructure of operations under a “one group” strategy.

Looking ahead, MHM Automation enters the 2022 financial year with good workflows across the company. The automation business has orders scheduled for delivery into 2023, and all areas of the business are running at or near capacity for the remainder of the 2021 calendar year. The company remains cognisant of opportunities for additional future acquisitions to align with its technology-led future.

Demand for automated solutions is forecast to continue to increase.

“With our portfolio of industry-leading solutions, we are well positioned to continue our trend of growth. The next 12 months will be focused on the execution of current work, improving margins, and building a sustainable pipeline of new opportunities globally,” Rookes said.